Income tax has always appeared as a tough task for common man. Planning tax is a herculean task for almost every taxpayer. As the Financial Year 2020-21 is ending in two weeks, considering the above issues, KIIT School of Commerce & Economics organized a workshop in virtual mode on the theme “TAX PLANNING WITH REGARDS TO INDIVIDUALS” on 19th March 2021, for the faculties and staffs of KIIT University. Prof. Sunil Gupta, CA, a tax expert and Professor of Management Studies, Indira Gandhi National Open University, Delhi graced the workshop as the Keynote Speaker.

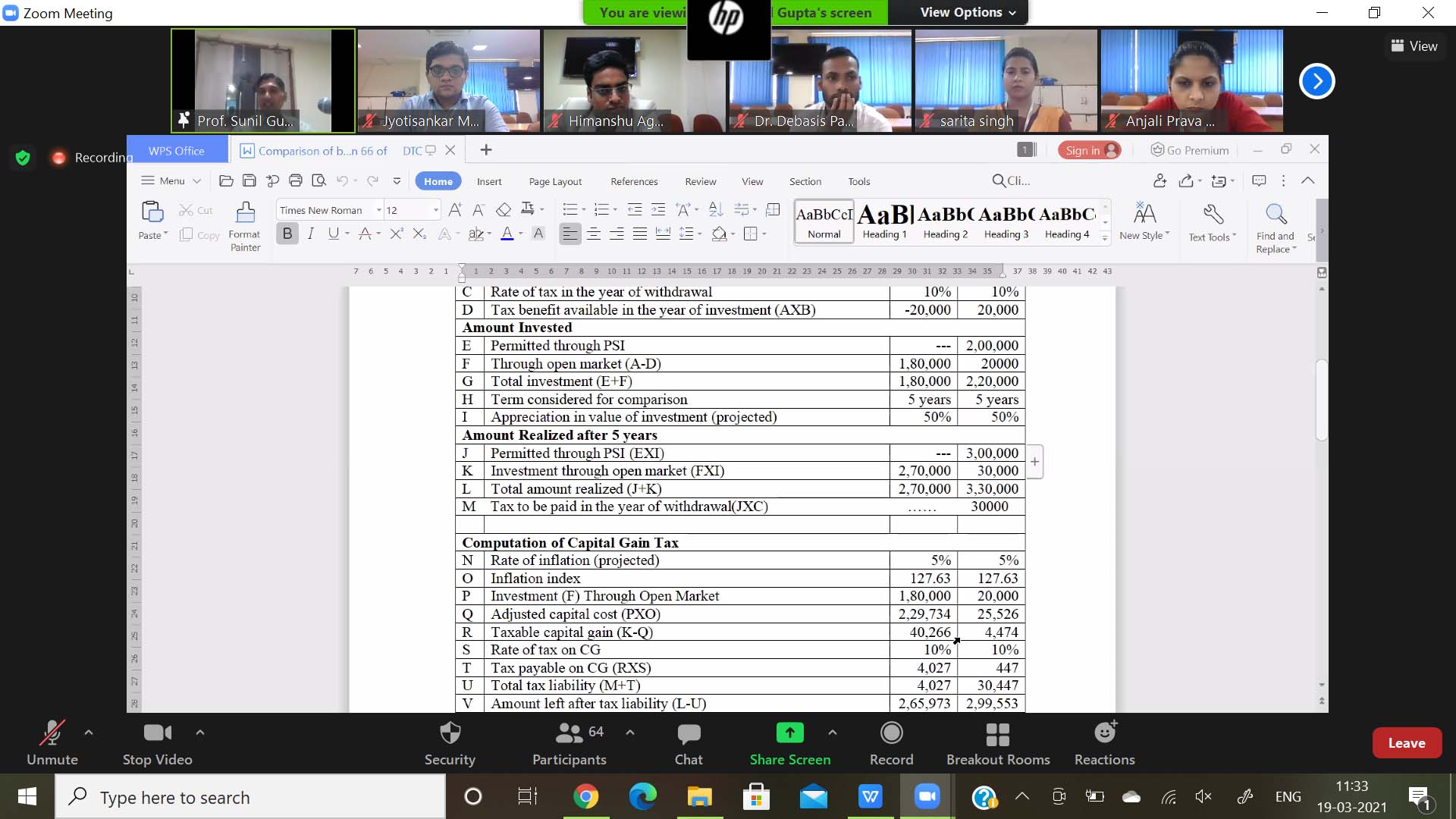

Prof. Gupta talked about various provisions of the Income tax Act applicable to individual assessee, explaining how an individual can plan their tax by making various investments. He also mentioned about the Direct tax Code (DTC), which the government is planning to bring into effect very soon, and what impact it is going to have on individual assessee. He explained in detail how the EEE(Exempt-Exempt-Exempt) system for specified investments will be replaced by EET(Exempt-Exempt-Tax) after the introduction of DTC and how the new system will be proved to be a win-win situation for both the taxpayers and the government. Prof. Sunil Gupta in a lucid manner deliberated on how the quantum aspect and time aspect have to be taken care of to make judicious investments.

Faculty Members, Staffs and students from different schools of KIIT had participated in huge number in the workshop and availed the benefit of learning a judicious investments and tax planning.